The required format of statutory accounts that small companies have to prepare and send to Companies House has changed. This factsheet sets out the choices that small companies now have. The nature of the company’s activities, the types of assets it has and whether external scrutiny is required/desired will need to be considered. We would be happy to assist you in providing specific advice for your company.

Contents

UK GAAP for small companies

- to use the same accounting standard as non-small UK companies – FRS 102

- to use the FRS 102 reduced disclosure regime (section 1A), or

- where relevant, to apply an alternative standard – The Financial Reporting Standard applicable to the Microentities – FRS 105.

Size limits for small and micro-entities

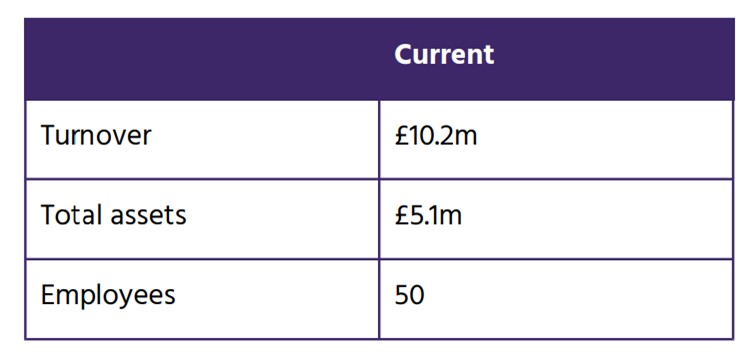

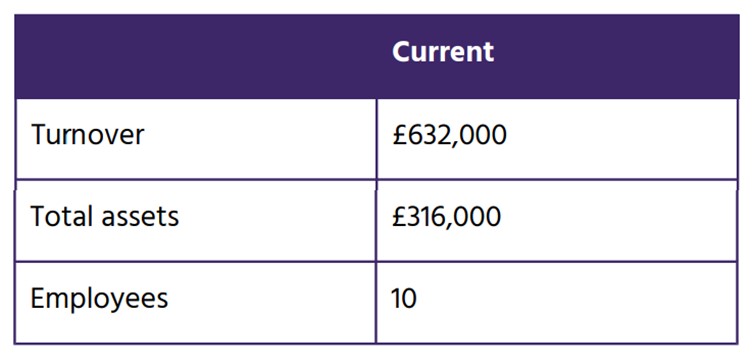

The size limits to qualify as a micro-entity are set out below:

A company needs to meet two out of three of the above criteria for two consecutive years to qualify as a small or micro company, unless it is the first year of the company’s existence, in which case only that year has to be considered. The turnover limit is adjusted if the financial year is longer or shorter than twelve months.

There are certain exclusions from the above small and micro-entity size limits which are set out in the Companies Act 2006. Certain types of entity are prohibited from preparing micro-entity accounts for example charities.

Small companies continue to have the option of not filing their profit and loss account and/or directors’ report at Companies House.

Small companies have the option of preparing less detailed accounts (abridged accounts) for members, providing every member agrees annually, and will be able to choose to abridge the balance sheet, the profit and loss account or both. Charities are also prohibited from preparing abridged accounts.

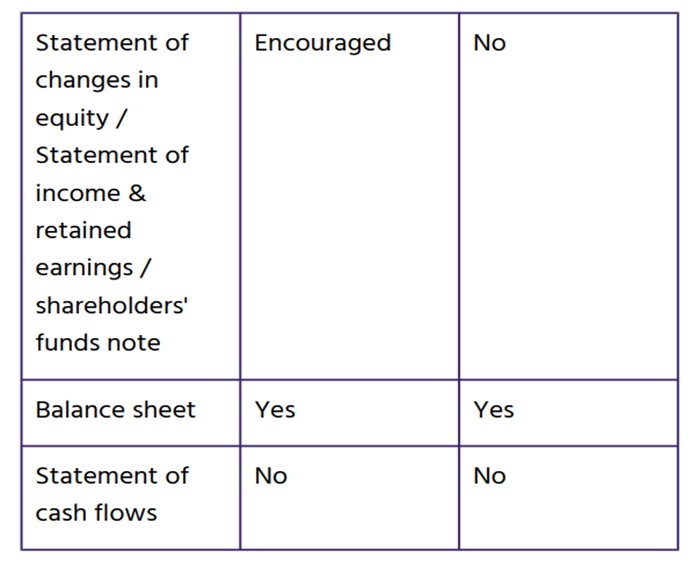

Contents of micro-entity accounts

The accounts of a micro-entity are considerably shorter and simpler than those otherwise required for a small company. Micro-companies are no longer required to prepare a Directors’ report. The profit and loss account and balance sheet include less detail. For example, current assets are shown in aggregated total on the balance sheet rather than being analysed into stocks, debtors and cash.

Notes of the following should be disclosed at the foot of the balance sheet:

- off-balance-sheet arrangements

- average monthly employees

- directors’ advances, credits and guarantees, and

- guarantees, contingencies and other financial commitments.

Only the balance sheet and the footnotes need to be filed at Companies House. The profit and loss account does not need to be filed. The company does not need to produce (nor file) typical small company notes such as:

- accounting policies

- post balance sheet events, and

- related party transactions.

FRS 105 imposes a simpler accounting treatment compared to FRS 102 Section 1A. There are numerous differences between FRS 102 Section 1A and FRS 105 but the most significant are as follows:

Revaluation / Fair value of assets

Fair value accounting is not permitted under FRS 105. By contrast, FRS 102 Section 1A permits (and in some cases requires) some assets to be measured at fair value annually.

The following assets and liabilities are most significantly impacted by fair value accounting under Section 1A:

- Investment properties, for example, those properties held to earn rental income, should be revalued every year to fair value.

- Forward foreign currency contracts require restatement to their fair value at the balance sheet date.

- Loans payable or receivable (for example to or from a director) falling due more than one year, with a nil or below-market rate of interest, must be measured at the present value of future cash flows, however, there is an optional relaxation of this requirement permitted within FRS 102 for small entities, in certain circumstances.

Deferred tax

FRS 105 does not allow companies to recognise deferred tax. By contrast, FRS 102 Section 1A requires deferred tax to be provided on fair value adjustments, and therefore likely to occur more frequently than before.

How we can help

We will be very pleased to discuss the impact on your small company of which accounting standard is to be used. If you would like to discuss these issues in more detail, please contact us.

Newsletter sign up

To keep up to date with our latest news, register for our newsletter.© 2021 Newby Castleman. All rights reserved.

Newby Castleman is the trading style of Newby Castleman LLP, a Limited Liability Partnership registered in England and Wales Number OC416058. A list of members’ names is available at the business address. Registered to carry on audit work in the UK and regulated for a range of investment business activities by the Institute of Chartered Accounts in England and Wales.

Related

Related