Making Tax Digital (MTD) for Income Tax.

Making Tax Digital (MTD) for Income Tax is being phased in from April 2026, and is a new way to record and report income and expenses.

The first group of taxpayers to be included are landlords and self-employed individuals with gross qualifying income of more than £50,000 from all sources. Therefore, someone who is both a landlord and self-employed will need to combine their income sources to determine whether they meet this threshold.

HMRC will then phase in more taxpayers by reducing the threshold to £30,000 from April 2027 and £20,000 from April 2028.

Those qualifying will need to use recognised software to keep their records of income and expenses. Quarterly updates will be sent to HMRC from this software – these aren’t tax returns, they are summaries of how a business is doing.

‘You won’t pay four tax bills a year; the deadline for paying your tax will still be 31 January.’ HMRC

Checklist

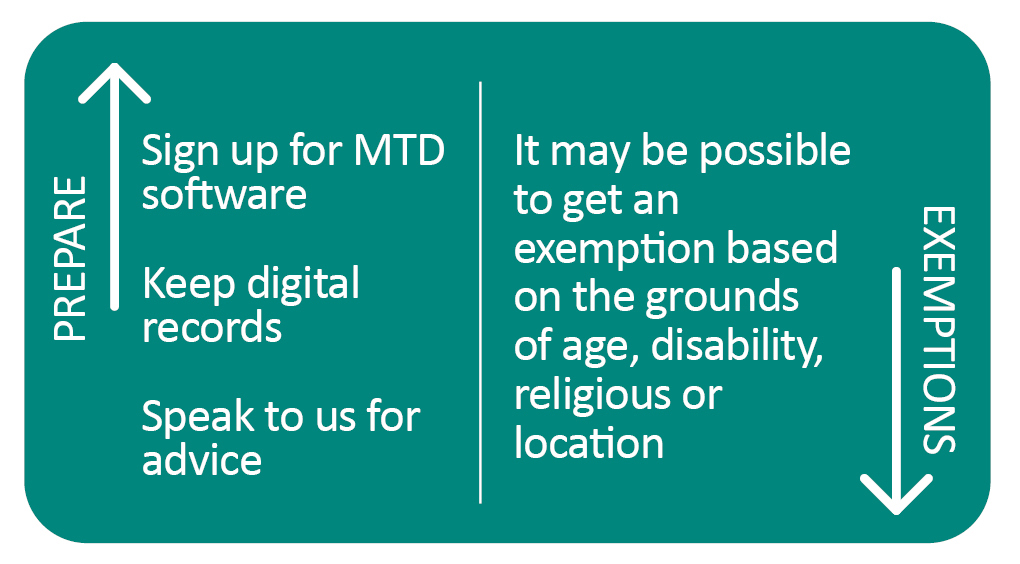

HMRC won’t sign taxpayers up automatically. If Making Tax Digital (MTD) for Income Tax is going to apply to you, we will be in touch to discuss what’s needed in more detail. We can also talk through the options for record keeping, and quarterly filing, so you can decide how much input you would like us to have, and how much you want to tackle yourself. These are the steps that need to be considered:

> Check if you are affected

> Find out your start date

> Choose your software

> Speak to your agent

> Sign up for testing

> Working out your qualifying income

Qualifying income

HMRC has also outlined how to work out your qualifying income:

‘Your qualifying income is the total income you get in a tax year from self-employment and property.’

HMRC will assess your gross income ( turnover) before you deduct expenses.

For example, if your gross income (income before you deduct expenses) could be:

– £30,000 from rental income

– £25,000 from self-employment income

In this example, your total qualifying income would be £55,000.’ HMRC

How HMRC will assess your qualifying income

‘To assess your qualifying income for a tax year, HMRC will look at the Self Assessment tax return that you submitted in the previous tax year.

For example, to assess your qualifying income for the tax year 2026 to 2027, HMRC will look at the tax return that you need to submit by 31 January 2026. This tax return is for the tax year 2024 to 2025. After you submit your return, HMRC will check if your qualifying income is more than £50,000. If it is, they will write to tell you when you must start using Making Tax Digital for Income Tax.’ HMRC

What’s included in qualifying income

– Your gross turnover from self-employment

– Your gross rental income from let properties

– Your share of joint property income i.e. if you have a 50% share, 50% of the gross income will be part of your qualifying income

– If you’re a beneficiary of a bare trust, any property or trading income that you’re entitled to will count towards your qualifying income.

– If you’re a beneficiary of an interest in possession trust, any property or trading income that is paid directly to you and bypasses the trustees will count towards your qualifying income.

– If the transactions in UK land rules apply and your income is treated as profits of a trade under the transactions in UK land rules, it will count towards your qualifying income where it is a continuing income source over more than one tax year.

– If you receive disguised investment management fees or income based carried interest, these forms of remuneration are treated as the profits of a deemed trade and will count towards your qualifying income.

– Income from a business partnership does not count towards your qualifying income

– The qualifying care receipts that you receive will not count towards your qualifying income.’ Source HMRC

How your tax residence affects your qualifying income

‘If you’re UK tax resident, your qualifying income will include your:

– Self-Employment Income

– UK and Foreign Property Income

If you’re not a UK tax resident, your qualifying income will include your:

– UK Property Income

– Self-Employment income that you have declared within your UK Self Assessment tax return (SATR)

If you have any income from a trade of dealing in or developing UK land, this will be included. Foreign property income and self-employment income that are not declared on your UK SATR will not count towards your qualifying income.’ Source HMRC

Contact

Planning is key to ensure a smooth transition. Please contact our team of experts who would be more than happy to assist you with the background, qualification and a way forward to adapt to these changes.

More

Making Tax Digital for Income Tax – exclusions

Making Tax Digital for Corporation Tax – scrapped

The ‘who, what and why’ behind Making Tax Digital for Income Tax

Email HELLO@NEWBYC.CO.UK Subject MAKING TAX DIGITAL for advice.

Newsletter sign up

To keep up to date with our latest news, register for our newsletter.

© 2026 Newby Castleman. All rights reserved.

Newby Castleman is the trading style of Newby Castleman LLP, a Limited Liability Partnership registered in England and Wales Number OC416058. A list of members’ names is available at the business address. Registered to carry on audit work in the UK and regulated for a range of investment business activities by the Institute of Chartered Accountants in England and Wales.

Related

Related